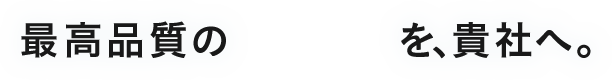

導入するなら気持ちよく、新品同様のビジネスフォンがいい。現行機種のビジネスフォンを、自社技術者が徹底クリーニング。悪いパーツは惜しみなく交換し、新品同様のビジネスフォンに仕上げます。

かかる費用は右表のとおり。明朗会計です。

導入するなら気持ちよく、新品同様のビジネスフォンがいい。現行機種のビジネスフォンを、自社技術者が徹底クリーニング。悪いパーツは惜しみなく交換し、新品同様のビジネスフォンに仕上げます。

かかる費用は右表のとおり。明朗会計です。

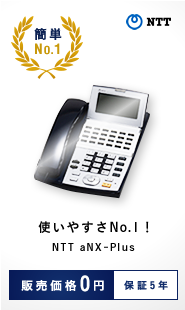

全メーカーの現行機種がずらり。新品同様のビジネスフォンの中から、貴社にマッチした機種を選びましょう。

もちろん喜んでご相談に乗ります。お客様の視点で。長くずっと快適に使ってほしいから。

当社にはひとりも営業マンはいません。

全てお客様視点で考え、全員が

「快適なオフィスの在り方」「製品知識」「工事技術」を

学んでいます。

納品後も電話一本ですぐにかけつけます。

気持よく笑顔で。

全てはお客様のために。

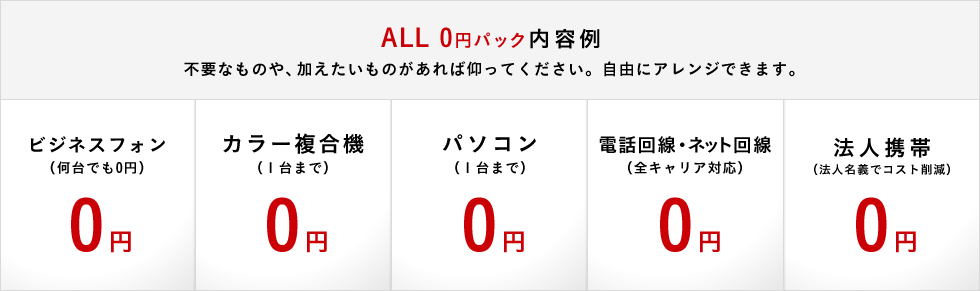

オフィスの開設、拡張、移転・・・。きっと多くの手続きや

備品の購入が必要でしょう。。実は私たちはサポートできること、

たくさんあります。もちろん全て高品質、業界最安値です。

業界最安が8.4円/3分ですが、

当社は更に安く、品質も安定しています。

SHARP MX-2301FN等多数

用紙サイズA3 複写速度 23枚/分

大規模〜スモールオフィス

まで対応

その他、オフィスの引越し、電話・ネット回線申込、

電話番号取得、LED蛍光灯なども対応

即日お見積りが基本です。機種選びについて、回線について、わからないことがあれば、

何でもお気軽にお尋ねください。知識・経験豊富なスタッフが誠心誠意対応させていただきます。

当社は、お客さまの個人情報を正確かつ最新の状態に保ち、個人情報への不正アクセス・紛失・破損・改ざん・漏洩などを防止するため、セキュリティシステムの維持・管理体制の整備・社員教育の徹底等の必要な措置を講じ、安全対策を実施し個人情報の厳重な管理を行ないます。

お客さまからお預かりした個人情報は、当社からのご連絡や業務のご案内やご質問に対する回答として、電子メールや資料のご送付に利用いたします。

当社は、お客さまよりお預かりした個人情報を適切に管理し、次のいずれかに該当する場合を除き、個人情報を第三者に開示いたしません。

お客さまが希望されるサービスを行うために当社が業務を委託する業者に対して開示する場合

法令に基づき開示することが必要である場合

当社は、個人情報の正確性及び安全性確保のために、セキュリティに万全の対策を講じています。

お客さまがご本人の個人情報の照会・修正・削除などをご希望される場合には、ご本人であることを確認の上、対応させていただきます。

当社は、保有する個人情報に関して適用される日本の法令、その他規範を遵守するとともに、本ポリシーの内容を適宜見直し、その改善に努めます。

当社の個人情報の取扱に関するお問い合せは下記までご連絡ください。

株式会社ベルテクノス

〒810-0022 福岡県福岡市中央区薬院3丁目13-11 サナ・ガリアーノ3F

TEL 092-791-4163 FAX 092-791-4164

Mail: